Business Insurance in and around Colorado Springs

Looking for small business insurance coverage?

Helping insure businesses can be the neighborly thing to do

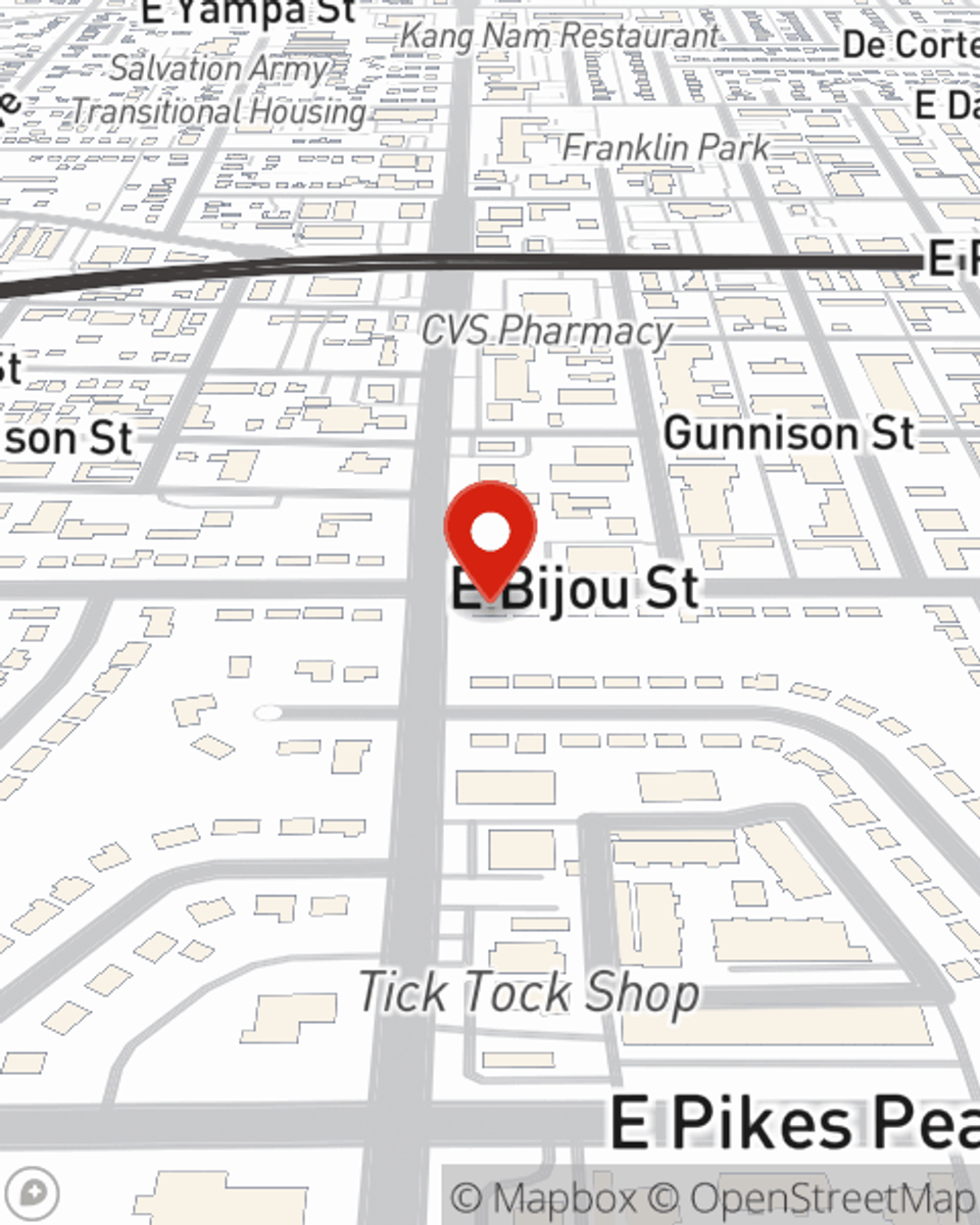

- Colorado Springs

- Falcon

- Peyton

- Denver

- Woodland Park

- Aurora

- Broadmoor

- Castle Rock

- Vail

- Fort Collins

- Lakewood

- Thornton

- Arvada

- Westminster

- Pueblo

- Centennial

- Greeley

- Boulder

- Highlands Ranch

- Longmont

- Loveland

- Broomfield

- Parker

- Security-Widefield

Business Insurance At A Great Price!

Running a business can be risky. It's always better to be prepared for the unfortunate accident, like an employee getting injured on your business's property.

Looking for small business insurance coverage?

Helping insure businesses can be the neighborly thing to do

Protect Your Business With State Farm

The unexpected is, well, unexpected, but it's better to expect it so that you're prepared. State Farm has a wide range of coverages, like worker's compensation for your employees or extra liability, that can be created to develop a personalized policy to fit your small business's needs. And when the unexpected does happen, agent Peter Martinez can also help you file your claim.

Take the next step of preparation and reach out to State Farm agent Peter Martinez's team. They're happy to help you learn more about the options that may be right for you and your small business!

Simple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

Peter Martinez

State Farm® Insurance AgentSimple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.